Personal loans can be an effective strategy for consolidating debt or paying off large expenditures over time. However, applying, qualifying, and selecting a loan that is most suited to your needs and offers you favorable conditions requires some homework.

Upstart is a lending platform that operates as a middleman between you and its lending partners/investors. Through Upstart, you can quickly get a personal loan starting from $1000 right up to $50000 at a low interest rates from 3.5% depending on your credit score.

Loan Amount & Terms$1000 – $50,000 The repayment terms is between 3 to 5 years |

Interest Rates APR3.50% – 35.99% The higher your credit score, the lower your interest rate. |

Upstart may be more accommodating to persons with lower-than-average credit scores because of its flexible credit score standards. Read this article on credit scores, if you don’t know what they are.

Brief about Upstart

Upstart is an online lending company that provides qualifying customers with personal loans. Upstart sets itself apart from other online lenders by focusing on an underrepresented demographic: young adults. As a result, while credit scores are considered, people with little or no credit history are nonetheless eligible for funding.

Unlike other premium lending platforms, Upstart does not require applicants to have a college diploma. The organization will work with anything, so don’t worry about having a credit score or a college diploma.

Who is Upstart personal loan for?

By going beyond credit history and examining various non-traditional credit indicators, Upstart gives borrowers with fair credit—those with a score of at least 300—access to personal loans. As a result, the platform is a viable choice for candidates who require funds immediately but are unlikely to be approved for a loan otherwise.

DO YOU HAVE CREDIT CARD DEBTS? SEE IF YOU QUALIFY FOR UPSTART CREDIT CARD CONSOLIDATION LOANS TO REDUCE YOUR INTEREST RATE>>>

Customers won’t have to borrow more than they need because Upstart offers $1,000 minimum loans in all states except Massachusetts ($7,000), Ohio ($6,000), New Mexico ($5,100), and Georgia, so they won’t have to borrow more than they need.

Upstart personal loan requirements

Legal residence and age of majority: If you wish to apply for an Upstart personal loan, you must be a U.S. resident in West Virginia or Iowa. In Alabama and Nebraska, you must be at least 19 years old, while you must be at least 18 years old in the rest of the country.

Minimum Loan Amount: The minimum amount you can borrow is $1000.

Employment Status: You have a steady source of income and a bank account in the United States.

Credit Score: You must have a credit score of at least 300, but the lower your credit score, the higher the interest rate. Delinquent or collection accounts, past-due sums, bankruptcies, or other public records from the last 12 months should appear on your credit report unless they are paid civil judgments or paid tax liens.

You must also have had fewer than six credit inquiries in the previous six months, excluding mortgages, auto loans, and student loans.

How is the process for getting upstart personal loans?

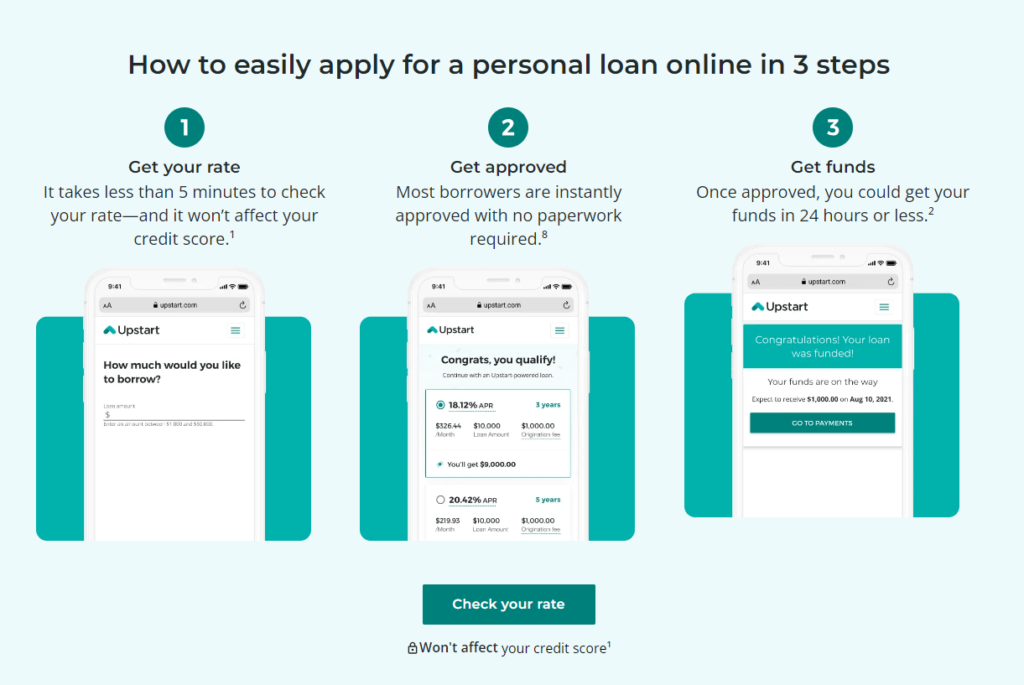

Upstart’s loan application and funding process are entirely online, requiring you to register an account, specify how much you want to borrow, and choose a loan purpose.

You’ll also have to provide personal information, such as academic and job background, and agree to a soft credit check, allowing Upstart to analyze your credit to verify your information and determine if you qualify for a loan.

If you’re approved, you’ll be given an estimated rate that includes your interest rate, origination fee, and other crucial information regarding your loan. Use this data to determine whether or not you wish to proceed.

Before you can acquire an official rate, you’ll need to supply more detailed information and have your application reviewed by a real person (the underwriter).

You’ll be required to provide several papers to validate the information you gave before. Transcripts, test scores, pay stubs, tax forms, and other formal evidence may be requested by Upstart.

SEE IF YOU QUALIFY FOR UPSTART PERSONAL LOANS >>>

Does Upstart Charge Any Fees?

Yes, Upstart charges an origination fee right up to 8%, depending on the loan amount. When borrowing, it’s critical to include in these fees since if you borrow $10,000 and pay an 8% fee, the amount you’ll receive is $9,200.

The origination cost is the only pre-funding fee. However, if your payment is more than ten days late, Upstart will charge you a late payment fee. If you don’t have enough money in your account to cover your payment, you’ll be charged an ACH or check return fee.

Despite the above, Upstart does not impose a prepayment fee, and paying off your loan early can save you money.

Frequently asked questions about upstart personal loans.

What Credit Score Should You Aim For? An Upstart loan may be available with a credit score as low as 300—however, the lower your credit score, the more expensive your loan. However, the credit score isn’t the only consideration for lenders.

Each lender has its own set of criteria for evaluating customers. Still, the majority include credit history, debt-to-income ratio (the percentage of monthly income spent on debt payments), and costs.

Where Does Upstart Run Its Business? Except in West Virginia and Iowa, Upstart loans are available worldwide.

What Are Some of the Online Features of Upstart? Upstart’s application procedure can be performed entirely online, from checking your rate to accepting the loan. Still, some candidates may be required to verify details over the phone as a security precaution.

You can make payments, adjust your monthly payment date, and set up regular payments through the borrower dashboard.

Bottom-Line

Upstart is a good option for people who do not match the typical model of a loan borrower because this lender is willing to analyze non-traditional sources of creditworthiness. Even if you don’t have a long credit history for any reason, you might be able to get low rates with this lender.

Although there have been a few complaints about Upstart, it is clear that most borrowers have had a positive experience with their personal loan offers.

Loan Amount & Terms$1000 – $50,000 The repayment terms is between 3 to 5 years |

Interest Rates APR3.50% – 35.99% The higher your credit score, the lower your interest rate. |

Furthermore, such criticisms are widespread in the lending sector as a whole. Any of Upstart’s competitors could turn you down for a loan or charge you extra costs.

Anyone thinking about acquiring a business loan from Upstart should do some comparison shopping before deciding on a lender.