Handling payroll can be a time-consuming task for you as a small business owners. This is why finding the perfect payroll company for small business needs is very crucial. The right payroll service can take the stress out of tax filings, compliance, and employee payments, allowing you to focus on growing your business.

Here are 9 of the most popular payroll companies for small businesses, along with their features, pricing, and benefits to help streamline your payroll process and keep your operations running smoothly.

Small Business Payroll Services Overview

| Company | Price | Main Benefit |

|---|---|---|

| Gusto | $39/month + $6/employee | Full-service payroll with HR tools |

| QuickBooks Payroll | $22.50/month | Seamless integration with QuickBooks |

| Paychex | Custom pricing | Comprehensive HR and payroll solutions |

| ADP | Custom pricing | Trusted, scalable solution for growing businesses |

| OnPay | $36/month + $4/employee | Affordable with HR tools |

| SurePayroll | $19.99/month | Budget-friendly for small businesses |

| Square Payroll | $35/month + $5/employee | Ideal for retail businesses with POS integration |

| Patriot Payroll | $10/month | Affordable basic payroll service |

| Rippling | Custom pricing | All-in-one HR, payroll, and IT management |

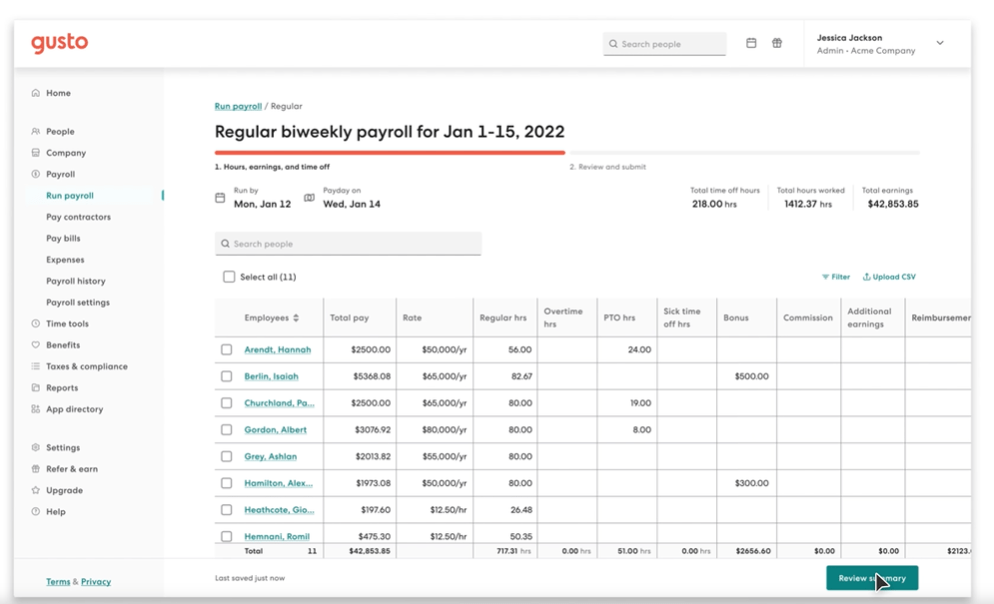

1. Gusto

Gusto is a full-service payroll provider that not only manages payroll but also offers benefits management, time tracking, and compliance support. It automatically calculates, files, and pays your payroll taxes while ensuring compliance with federal, state, and local tax laws.

Pricing: Starts at $39 per month, plus $6 per employee.

Benefits: Gusto is known for its simple setup and user-friendly interface, making it perfect for small business owners who want to automate their payroll without added complexities.

With features like health insurance administration and retirement planning, Gusto offers more than just payroll, giving you comprehensive HR tools in one package.

Check Gusto out for more details

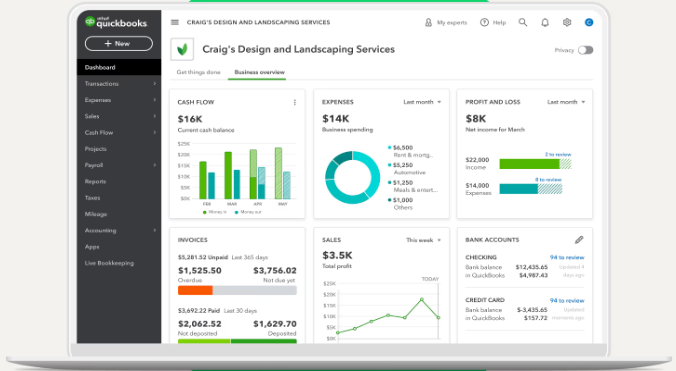

2. QuickBooks Payroll

QuickBooks Payroll integrates seamlessly with QuickBooks accounting software, offering automatic payroll, same-day direct deposit, and tax penalty protection. It helps you manage your payroll taxes, track employee hours, and stay on top of your payroll expenses.

Pricing: Starts at $22.50 per month.

Benefits: If you’re already using QuickBooks for accounting, this payroll service is a natural fit.

The integration ensures that all your payroll data syncs seamlessly with your financial records, making it easier to manage your business finances in one place.

Learn more about this payroll company

3. Paychex

Paychex offers a full suite of services that include payroll, tax administration, employee screening, and HR support. It’s a scalable solution, meaning as your small business grows, Paychex can grow with you.

Pricing: Customizable pricing based on your needs.

Benefits: Paychex is ideal for small businesses that are looking for more than just payroll processing. Its robust HR tools make it an attractive option for companies looking for a solution that will support both their payroll and HR needs.

4. ADP

ADP is a well-known provider that offers payroll processing, tax filing, and a host of HR tools. Its platform allows small businesses to run payroll online or via mobile app, automate tax filings, and manage employee benefits.

Pricing: Custom quotes are available depending on your business’s size and needs.

Benefits: ADP is trusted by many businesses and offers a comprehensive suite of services that cater to both payroll and HR functions.

For small businesses expecting growth, ADP’s scalability makes it a solid choice.

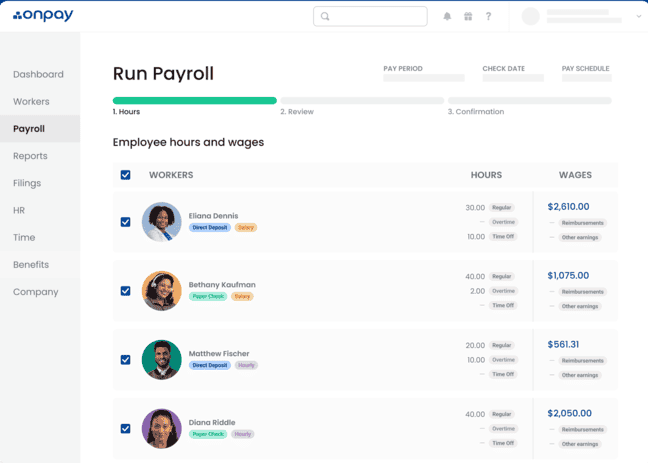

5. OnPay

OnPay offers payroll, benefits management, and HR services in a streamlined, cloud-based platform.

It automatically handles payroll tax filings and compliance, while also offering tools to manage employee benefits like health insurance and 401(k) plans.

Pricing: $36 per month, plus $4 per employee.

Benefits: OnPay’s ease of use and flexibility make it an excellent option for small businesses that want to simplify the payroll process while also managing benefits.

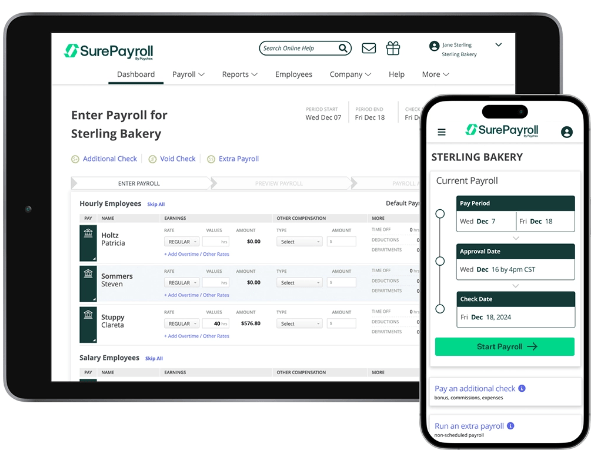

6. SurePayroll

SurePayroll is a cost-effective solution that offers payroll processing, tax filing, and access to an intuitive mobile app for payroll management on the go.

Pricing: Starts at $19.99 per month.

Benefits: SurePayroll is one of the most affordable options on this list, making it perfect for small businesses with fewer employees. Despite the low price, it still offers a comprehensive range of payroll services.

7. Square Payroll

Square Payroll lets you pay contractors and employees, manage tax filings, and track employee hours through timecards. It integrates seamlessly with Square’s point-of-sale system, making it ideal for retail businesses.

Pricing: $35 per month, plus $5 per employee.

Benefits: If you’re already using Square for transactions, Square Payroll is a great extension of their system. Its integration with the point-of-sale system streamlines the payroll process, ensuring you never miss a payment or tax filing.

8. Patriot Payroll

Patriot Payroll offers both basic and full-service payroll options, with features like tax filing, direct deposit, and payroll management.

Pricing: Starts at $10 per month for the basic package.

Benefits: Patriot is an affordable option for small businesses that want flexibility. You can choose between a more hands-on approach or opt for their full-service solution to automate most of your payroll tasks.

Learn More about Patriot Online Payroll Software

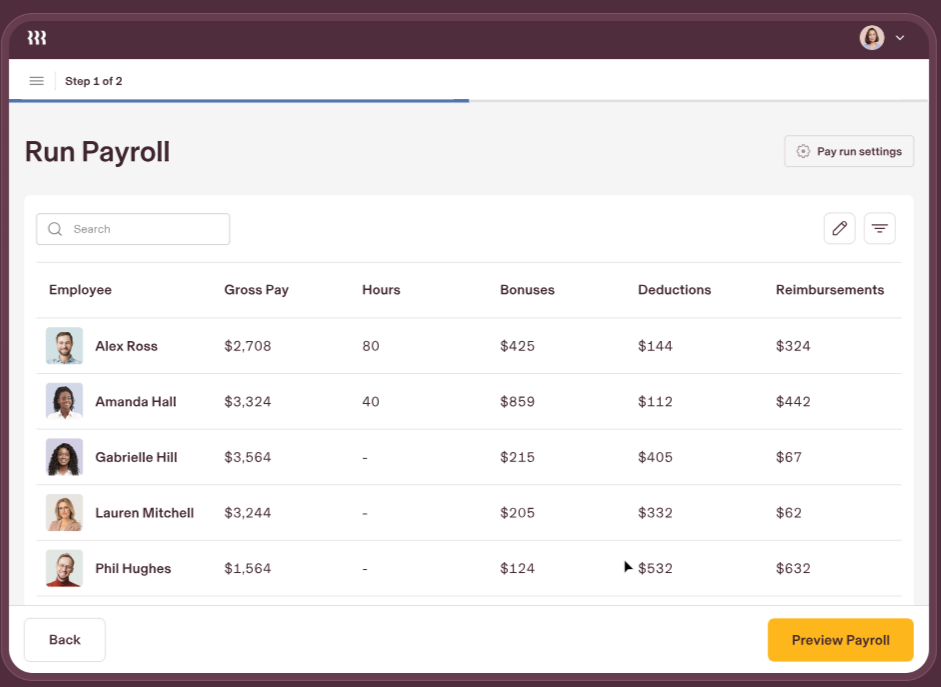

9. Rippling

Rippling combines payroll, benefits, and device management in one platform. It’s an all-in-one solution that covers everything from running payroll to managing employee devices and apps.

Pricing: Custom quotes are available.

Benefits: Rippling is more than just a payroll service. Its ability to integrate various aspects of HR and IT management into one system makes it an excellent choice for small businesses that want to centralize operations.

Bottom Line

Choosing the right payroll company is a vital decision for your small business. Whether you’re looking for something budget-friendly, scalable, or packed with HR tools, the payroll companies listed above offer solutions tailored to meet the specific needs of your small business.

Each of these services can help you streamline your payroll process, avoid compliance issues, and save time.

Take the next step in automating your payroll and improving your business’s efficiency by exploring these options today. No matter which service you choose, simplifying your payroll process will allow you to focus on what really matters: growing your business.