Navigating the auto financing maze can be challenging. One of the most pressing questions for potential car buyers is: “How much should my car payment be?” While it’s tempting to freely spend on your dream car, it’s essential to strike a balance between driving the vehicle you desire and ensuring your financial stability.

This guide delves into the factors that influence your car payment, offering practical insights and hypothetical scenarios to help you make an informed decision. Whether you’re a first-time car buyer or considering an upgrade, understanding how to budget for your car payment can pave the road to a smoother financial journey.

So how much should your car payment be?

Let’s dive into a step-by-step approach to determining the ideal car payment for your unique situation.

1. Determine Your Monthly Take-home Pay:

For our hypothetical example, let’s say you earn $60,000 annually after taxes. To find the monthly take-home pay:

Monthly Take-home Pay = Annual Take-home Pay / 12

Your monthly take-home pay is the amount of money you bring home after all deductions, such as taxes, social security, and any other withholdings, have been subtracted from your gross salary. This is the actual amount that lands in your bank account and serves as the foundation for your budget. It’s essential to base your calculations on this figure rather than your gross income because it reflects your actual spending power.

To determine your monthly take-home pay, review your paystubs or bank statements. If you receive irregular income, such as from freelance work, calculate an average over several months to get a realistic figure. You can also use our Net Monthly Income Calculator to determine your take-home monthly income.

Remember, understanding your take-home pay is the first step in ensuring that your car payment aligns with your financial reality.

2. Calculate the Recommended Car Payment

A common guideline suggests that your car payment should be no more than 15% of your monthly take-home pay:

Car Payment = 0.15 * Monthly Take-home Pay

When determining an appropriate car payment, it’s helpful to have a guideline or benchmark to start with. Many financial experts suggest that your car payment should not exceed 15% of your monthly take-home pay. This recommendation provides a balance, allowing for manageable payments while also considering other financial obligations and goals.

To calculate the recommended car payment, multiply your monthly take-home pay by 0.15 (or 15%). While this is a general guideline, it’s crucial to consider your unique financial situation.

Some people might be comfortable allocating a slightly higher percentage due to fewer expenses in other areas, while others might prefer a more conservative approach, especially if they have significant financial commitments elsewhere. By starting with this benchmark, you set a foundation upon which you can adjust based on your individual needs and circumstances.

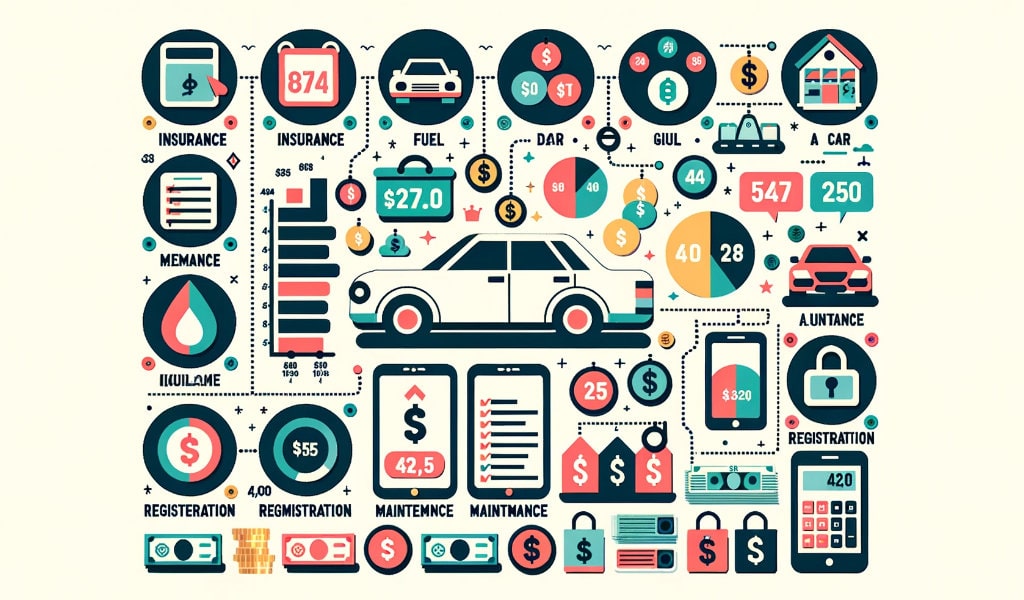

3. Consider Other Expenses

Owning a car involves more than just the monthly loan payment; there are various associated costs that can significantly impact your overall automotive budget. Before committing to a specific car payment, it’s crucial to factor in these additional expenses to ensure you’re not stretching your finances too thin.

For our example, let’s assume:

Insurance: $100/month

Fuel: $150/month

Maintenance and repairs: $50/month

Registration and licensing: $10/month

Total monthly car-related expenses (excluding the car payment) would be:

Total Monthly Car Expenses = Insurance + Fuel + Maintenance and Repairs + Registration and Licensing

Insurance: This is a mandatory expense in most places. The cost can vary based on your vehicle’s make and model, your driving history, and the coverage level you choose. It’s wise to get a few insurance quotes for the car models you’re considering before making a purchase.

Fuel: The type of car you buy, its fuel efficiency, and how often you drive will determine your monthly fuel costs. A gas-guzzling SUV will cost more at the pump than a fuel-efficient compact car.

Maintenance and Repairs: Regular maintenance, like oil changes, tire rotations, and brake checks, are essential for your car’s longevity and safety. Additionally, unexpected repairs can arise, so it’s good to have a buffer in your budget for these occurrences.

Registration and Licensing: These are often annual or biennial fees that vary by location. It’s essential to be aware of these costs and factor them into your budget.

Depreciation: While not a direct out-of-pocket expense, it’s essential to remember that most cars depreciate over time. When pondering “how much should my car payment be?”, considering the vehicle’s depreciation is crucial. Choosing a car that retains its value well can save you money in the long run, especially if you plan to trade in or sell the vehicle later.

By taking a holistic view of car ownership costs, you can ensure that your budget is realistic and sustainable, preventing any financial surprises down the road.

4. Adjust the Car Payment Based on Expenses

After summing up the various expenses associated with car ownership, it’s crucial to re-evaluate and potentially adjust the amount you’re willing to allocate toward a car payment. These adjustments are necessary to ensure that the total monthly outlay for your vehicle remains within your budgetary constraints.

Revisit Your Budget: Start by revisiting your initial car payment estimate based on your monthly take-home pay. Compare this figure with the total combined expenses of insurance, fuel, maintenance, and other related costs.

Flexibility is Key: Remember, your car payment isn’t set in stone. While you might have started with a target based on the 15% guideline, real-world expenses can dictate a need for flexibility. If your associated car costs are higher than anticipated, consider reducing the amount you’re willing to pay monthly for the car loan.

Total Cost of Ownership: It’s essential to think in terms of the total cost of ownership, not just the monthly payment. If, for instance, you’re considering a vehicle that has exceptional fuel efficiency or requires less frequent maintenance, you might feel comfortable with a slightly higher car payment since you’ll save in other areas.

Future Considerations: While it’s crucial to budget for the present, also consider potential future changes in your financial situation. Factors like potential job changes, upcoming large expenses, or changes in family size can influence your ability to manage your car payment and associated costs.

By thoroughly adjusting the car payment based on a comprehensive understanding of all associated expenses, you ensure a more balanced and manageable financial commitment to your vehicle.

5. Research and Shop Within Your Budget

Before stepping foot into a dealership or browsing online listings, it’s imperative to have a clear understanding of your budget. This clarity ensures you make a financially sound decision that aligns with your economic realities.

Knowledge is Power: Familiarize yourself with the current market prices for the type and model of car you’re interested in. This knowledge can be a powerful tool during negotiations and can help you identify a good deal when you see one.

Avoid Upselling: Sales representatives might attempt to upsell additional features, packages, or even more expensive models. By having a firm grasp on your budget, you can resist the allure of unnecessary upgrades that exceed your financial limits.

Consider Total Ownership Costs: The sticker price isn’t the only factor. Remember to account for taxes, registration, dealership fees, and potential interest on loans when determining the final cost.

Used vs. New: Depending on your budget, you might find better value in purchasing a used car in good condition rather than a new one. This decision could allow you to get more features or a better model for the same price.

Online Tools and Reviews: Utilize online tools and platforms that provide insights into car prices, user reviews, and historical data on specific models. These resources can be invaluable in ensuring you get the best value for your money.

Be Patient: It’s essential to take your time during this process. Rushing might lead you to overlook better deals or commit to a purchase that’s beyond your budget. Waiting for seasonal sales or promotional periods can also lead to significant savings.

By diligently researching and shopping with your budget as the guiding factor, you not only secure a vehicle that meets your needs but also ensure that the financial commitment remains sustainable in the long run.

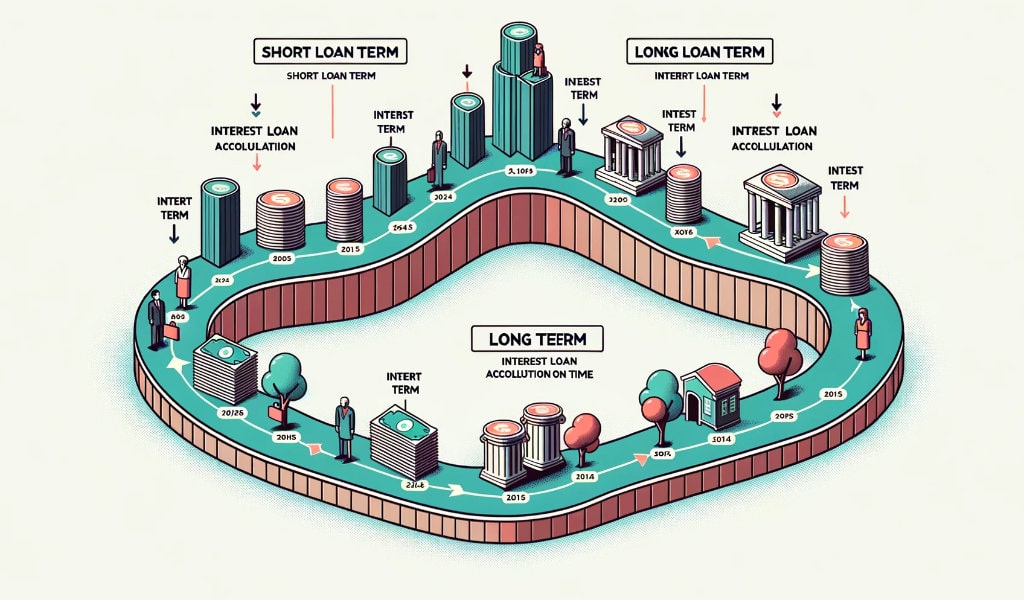

6. Consider the Loan Term

When contemplating the question, “how much should my car payment be?”, the loan term emerges as a pivotal factor. The duration over which you choose to repay your car loan can significantly influence both your monthly payment and the total amount paid over the life of the loan.

Shorter vs. Longer Terms: Typically, shorter loan terms have higher monthly payments but accrue less interest overall. Conversely, longer terms might provide relief with lower monthly payments, but they often result in paying more interest over the life of the loan.

Interest Implications: Even a slight difference in interest rates can amount to a substantial sum over several years. It’s essential to calculate the total interest you’ll pay over different loan terms to understand the full financial implications.

Financial Flexibility: A shorter loan term might restrict your monthly budget more than a longer term. However, paying off the car sooner can provide financial freedom and flexibility in the future, especially if you anticipate significant expenses or life changes down the line.

Equity and Depreciation: With longer loan terms, there’s a risk of becoming “upside down” on your loan, meaning you owe more than the car is worth due to depreciation. This situation can be problematic if you plan to sell or trade in the vehicle before the loan is paid off.

Future Financial Goals: Think about your long-term financial aspirations. If you’re aiming to be debt-free in a specific timeframe or are planning significant expenditures like buying a house, the loan term can impact those goals.

Incorporating the loan term into your decision-making process ensures a comprehensive understanding of “how much should my car payment be?” and helps align your car purchase with broader financial objectives.

7. Remember to Save for a Down Payment

In the journey of car ownership, a down payment often serves as the initial stepping stone. This upfront payment can significantly influence your financial commitment, loan terms, and overall experience. Here’s why prioritizing a down payment is crucial:

Reduction in Loan Amount: A substantial down payment directly reduces the amount you need to finance. This reduction can lead to lower monthly payments and potentially better loan terms, making the question of “how much should my car payment be?” more manageable to answer.

Interest Savings: By decreasing the loan amount through a down payment, you inherently reduce the total interest paid over the life of the loan, saving money in the long run.

Better Loan Approval Odds: Lenders often view borrowers willing to make a significant down payment more favorably. This perceived reduced risk can lead to higher chances of loan approval and possibly better interest rates.

Protection Against Depreciation: Cars depreciate rapidly, especially in the first few years. A sizeable down payment can help ensure that you don’t end up owing more on the car than it’s worth, a situation often termed as being “upside down” on a loan.

Flexibility in Financial Hiccups: By having equity in your car from the outset, you grant yourself a safety net. If unexpected financial challenges arise, you might have the option to sell the vehicle without being at a loss.

Improved Budgeting: Saving for a down payment requires discipline and planning. This process can help hone your budgeting skills, preparing you for the financial responsibility of monthly car payments.

As you contemplate on how much should your car payment be, the down payment emerges as a critical component, influencing not just immediate costs but the long-term financial trajectory of car ownership.

8. Re-evaluate Periodically

Financial landscapes, both personal and macroeconomic, are dynamic and ever-changing. As you navigate the path of car ownership and loan repayment, it’s essential to periodically reassess your situation to ensure that you’re on the most advantageous track.

Changing Financial Situations: Over time, your income might increase, or unforeseen expenses might arise. Regularly reviewing your budget can help you determine if you can allocate more towards your car payment to pay off the loan faster or if you need to tighten your belt and find ways to save.

Interest Rate Changes: In some cases, especially with adjustable-rate auto loans, interest rates might fluctuate. Keeping a finger on the pulse of prevailing market rates can help you decide if refinancing your car loan makes sense.

Vehicle Needs: As time progresses, your needs from a vehicle might change. Whether it’s due to an expanding family, a job change requiring longer commutes, or evolving preferences, it’s beneficial to assess if your current vehicle still aligns with your lifestyle.

Vehicle Condition: Wear and tear are natural over time. Periodically evaluating the condition of your car can help you anticipate major upcoming maintenance or decide if trading in for a newer model is a more cost-effective solution.

Market Value: Keeping an eye on your car’s market value versus the outstanding loan amount can be insightful. If the vehicle’s value significantly surpasses the loan balance, it might be an opportune time to trade or sell.

Personal Financial Goals: As life evolves, so do financial goals. Whether you’re eyeing a home purchase, considering further education, or planning significant travels, revisiting your car payment and associated expenses can ensure alignment with broader objectives.

By taking the time to periodically re-evaluate your car payment situation, you foster a proactive approach, ensuring that your decisions remain in harmony with both your immediate needs and long-term financial aspirations.

Bottom-Line

Navigating the complexities of auto financing might seem like a daunting task at first. However, with the right guidance and a comprehensive understanding of factors influencing your car payment, you can confidently steer your way through this financial maze.

By taking into account your monthly take-home pay, considering all associated expenses, and periodically re-evaluating your situation, you’ll be better equipped to make informed decisions.

Whether you’re a seasoned car owner or a first-time buyer, keeping the question “how much should my car payment be?” at the forefront of your mind ensures a smoother financial journey. Remember, while a car serves as a means of transportation, the decisions surrounding its purchase can significantly impact your financial road ahead.